Now more than ever, businesses are under a microscope for their environmental, social and governance (ESG) efforts. Consumers and stakeholders expect the companies they support to not only have an ESG strategy but also to be accountable for the plans they have articulated.

During uncertain economic times, it can be difficult to prioritize ESG initiatives when there is the urge to tighten budgets. But today, ESG efforts are more than just a “nice-to-have.” ESG can have a critical impact on an organization’s business strategy and development.

Key company stakeholders, including board members, investors, employees and customers, all expect businesses to do more to address societal issues, with only 52% in a recent study from Edelman indicating they believe business is currently doing enough to address climate change. There’s also an increasingly clear link between brand strength and a company’s sustainability practices, as more customers seek out brands and businesses that uphold good environmental and social practices. According to data from Bain & Company, the brands that scored highest on sustainability generated five times the revenue growth of companies scoring lowest.

ESG efforts also impact the employee experience.

Today, high ESG performance is linked to improved employee satisfaction and attracting prospective employees, especially among younger generations who place a greater emphasis on environmental and social concerns. Even the majority of consumers say they are more likely to buy from a company that stands up for ESG efforts.

There are a few steps an organization can take to make an impact while keeping its bottom line intact. Over the last few years, my organization, Stericycle, has embarked on its own ESG journey, which has helped us grow as a provider of waste disposal solutions spanning several industries and leaders in our own community. Here are three ESG investment models to consider leveraging that can result in tangible results for your organization as well as the communities in which you serve.

1. Upgrade your physical infrastructure.

If your organization has been around for a few decades, chances are there are areas of your facility or facilities and operations that could use an upgrade. For example, offices can upgrade to LED lighting to use less energy. Driver routes can be re-evaluated to find efficiencies, which can reduce mileage and CO2 emissions from diesel-powered vehicles. Improvements to machinery and equipment also have the potential to help your facility use less energy over time and improve productivity.

Additionally, any new facilities or offices in development should be evaluated for ways to optimize energy savings and operations. This past year, one of our latest equipment upgrades created a 40% reduction in overtime compared to 2021 and an approximate 20,000-mile-per-month long-haul optimization improvement. Strategic upgrades and improvements can use your current resources more efficiently and effectively, which can save on overhead and make long-term impacts on the environment.

2. Evaluate and leverage your partners and vendors.

Part of your business strategy should be partnering and working with other organizations that have strategic ESG goals. When re-evaluating contracts, review your vendors’ ESG goals and efforts to ensure they are doing their part for the environment and social issues. Many organizations today are making a commitment to only work with partners that are making real efforts. Organizations with good ESG scores know that their entire supply chain is making strides to be more environmentally and socially considerate.

Vendors and partners can also work together to help each other find efficiencies and/or improve operations. The right partnership can result in improving products and services or making your supply chain more efficient. For example, when my organization was developing new medical waste containers that would be stronger, nestable and stackable, we cultivated a partnership with the company Cupron to use their copper-based antimicrobial additive in order to help prevent the growth of bacteria, fungi, mold and mildew on the containers. Overall, this partnership enabled a better solution for the storage, collection and transportation and more of these containers while improving customer and employee satisfaction in turn.

3. Be a steward of your community.

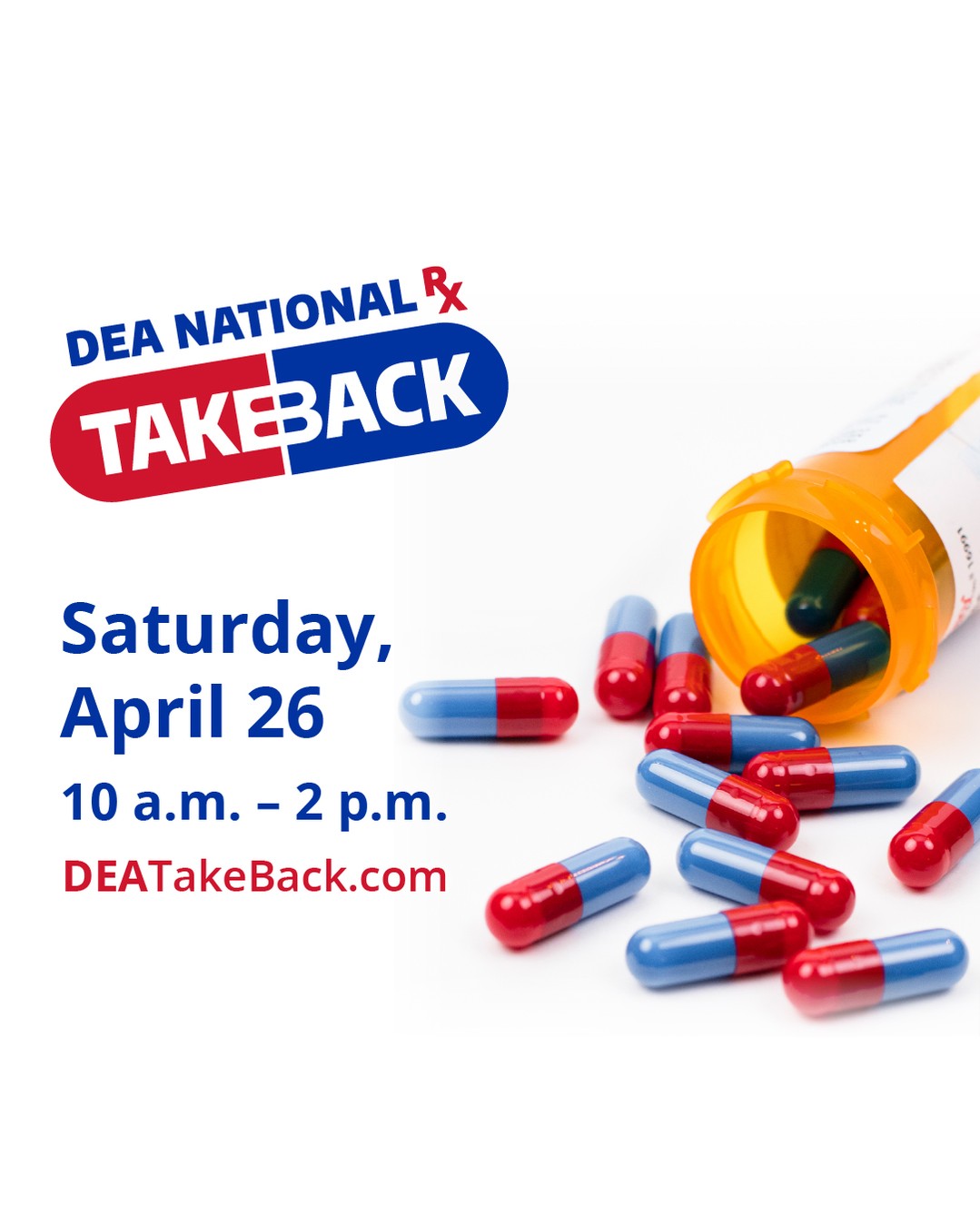

Many organizations contribute to some form of philanthropy effort every year. Evaluate those efforts and determine whether and where adjustments could be made to pivot the focus to better realize your organization’s values and ESG goals. For example, if your organization values community health and well-being, find a local or national partner to restore or build a park within the community you serve. Some organizations also provide their employees with a certain number of paid volunteer hours per year, allowing them to go into their local communities and serve on behalf of your organization.

Environmental justice should also be a priority for good organizational stewardship. Your organization exists within a community and, most likely, impacts that community in unseen or unexpected ways. Therefore, it’s important to understand the dynamics of the communities where you operate. To do this, you can form a task force that gets involved in and connects with the community to help inform business decisions, to try to avoid any undue environmental or societal burden and to better support the community.

One thing we do know is that it’s never been more important to do our very best to protect our environment, our communities and our people. Large-scale ESG initiatives can be difficult to get off the ground, even in the most economically prosperous of times. But we can all make smaller strategic changes that, when combined, can have a real impact on our world and our bottom line.

This content, 3 ESG Investment Models That Support The Bottom Line, was originally shared by Forbes on March 8, 2023.